Running a small business is demanding. Juggling clients, projects, and finances can feel overwhelming. One crucial aspect often overlooked is efficient invoicing. Manual invoicing is time-consuming, prone to errors, and ultimately hinders growth. This is where small business invoice software steps in, offering a streamlined solution to manage your billing and finances effectively.

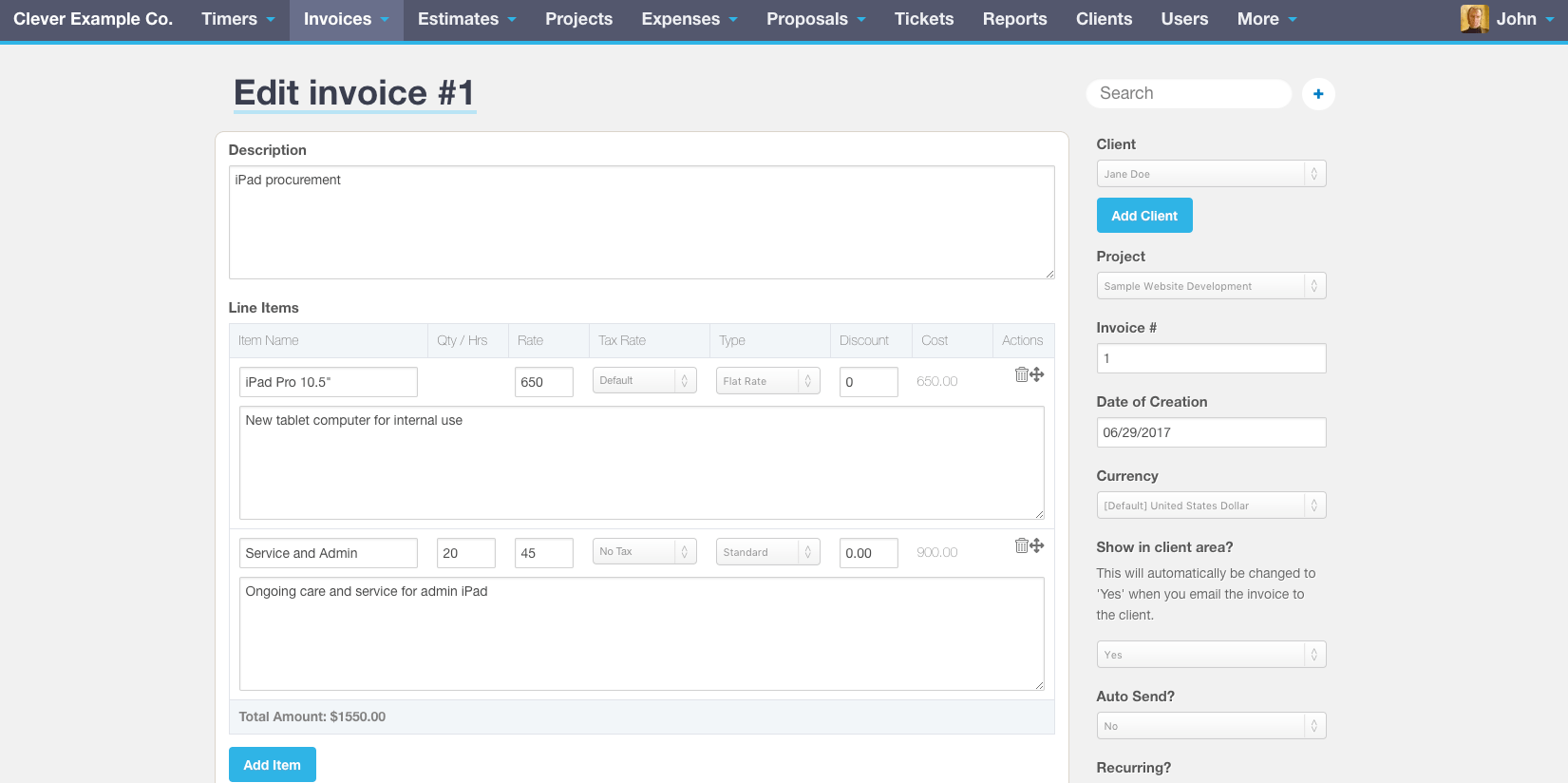

Source: smallbusinesshq.co

This comprehensive guide will explore the benefits, features, and considerations involved in choosing the right invoice software for your needs.

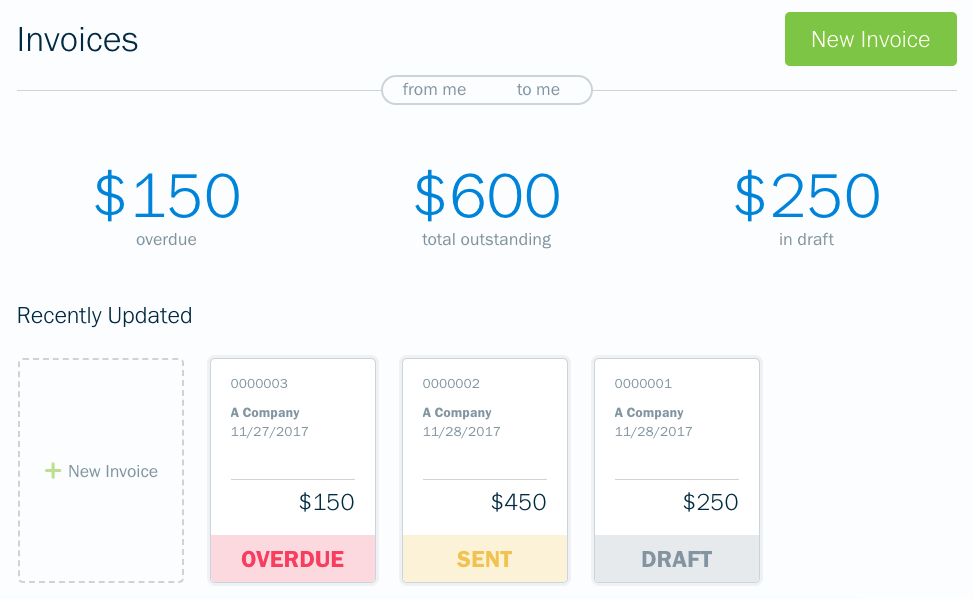

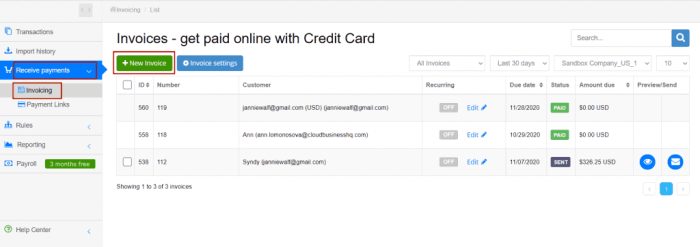

Source: zapier.com

Understanding the Importance of Invoice Software for Small Businesses

In today’s digital landscape, efficient invoicing is not a luxury; it’s a necessity. Small business invoice software offers a range of benefits that can significantly impact your bottom line and overall business operations. These benefits include:

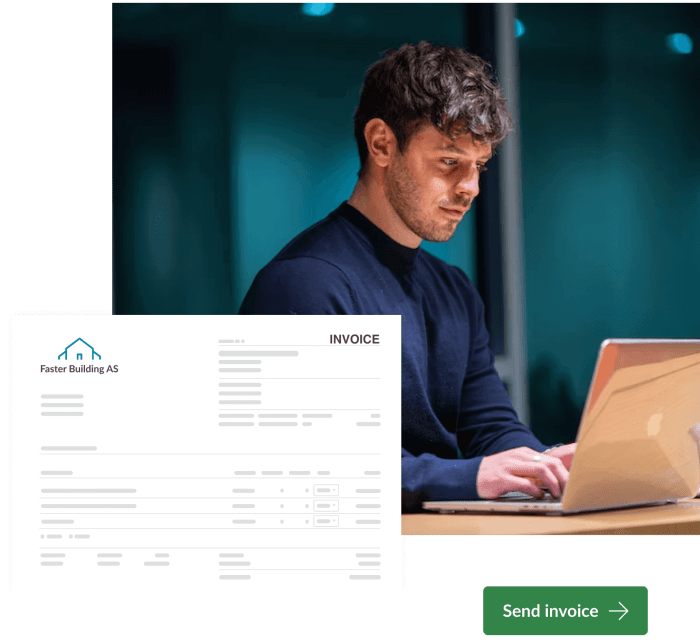

Source: invedus.com

- Time Savings: Automation eliminates manual data entry, freeing up valuable time for core business activities.

- Reduced Errors: Software minimizes human error, ensuring accurate invoices and payments.

- Improved Cash Flow: Faster invoicing and payment tracking lead to improved cash flow management.

- Professional Image: Customizable invoices create a professional brand image and enhance client relationships.

- Enhanced Organization: Centralized invoice storage and management improve organization and simplify record-keeping.

- Better Client Communication: Many software options offer features for easy client communication and payment reminders.

- Scalability: As your business grows, the software can often scale to accommodate increased workload.

Key Features to Look for in Small Business Invoice Software

Choosing the right invoice software requires careful consideration of your specific needs. Here are some essential features to look for:

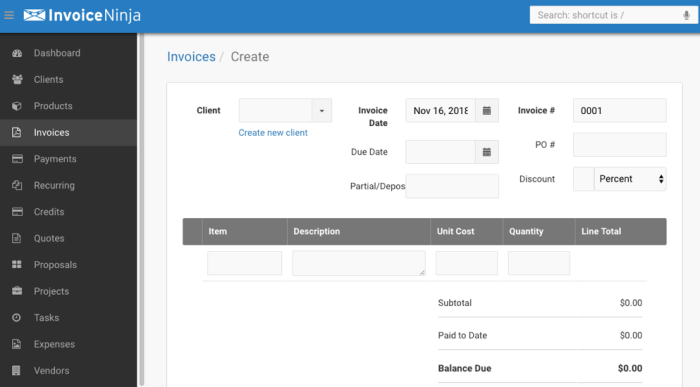

Source: tailorbrands.com

Essential Features:

- Invoice Creation and Customization: The ability to create professional, customizable invoices with your logo, branding, and payment terms.

- Client Management: A system for managing client information, including contact details and payment history.

- Payment Processing Integration: Seamless integration with payment gateways like PayPal, Stripe, or Square for faster payments.

- Expense Tracking: Ability to track expenses related to projects or clients for accurate profitability analysis.

- Reporting and Analytics: Detailed reports on outstanding invoices, payments received, and overall financial performance.

- Automated Reminders: Automated email or SMS reminders to clients about overdue payments.

- Recurring Invoicing: Ability to schedule recurring invoices for subscription-based services or regular payments.

Advanced Features (Consider based on your needs):, Small business invoice software

- Time Tracking: Integrate time tracking to accurately bill clients based on hours worked.

- Project Management Integration: Connect with project management tools for streamlined workflow and billing.

- Inventory Management: Track inventory levels and costs for accurate invoicing.

- Multi-currency Support: Handle invoices in multiple currencies for international clients.

- Collaboration Features: Allow team members to access and collaborate on invoices.

- API Integrations: Integrate with other business tools for a more connected workflow.

Types of Small Business Invoice Software

Small business invoice software comes in various forms, each with its own strengths and weaknesses. The best choice depends on your specific needs and budget.

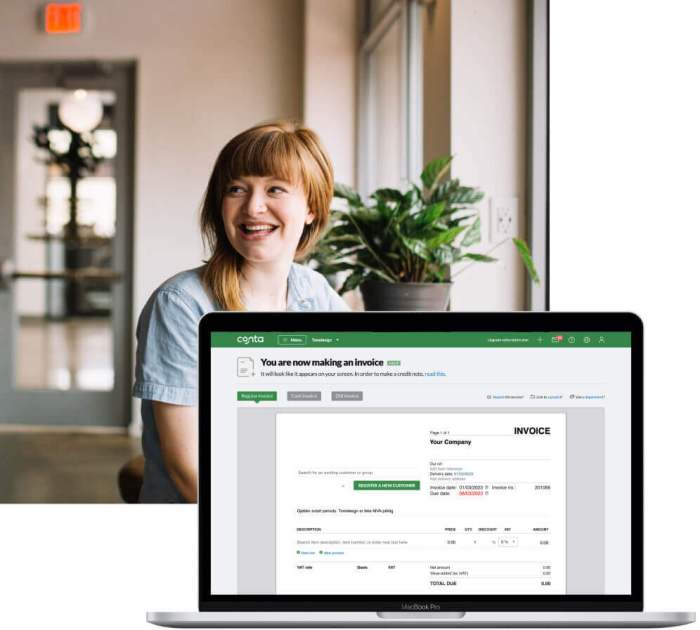

Source: conta.com

- Cloud-Based Software: Accessible from anywhere with an internet connection, offering collaboration and data security.

- Desktop Software: Installed on your computer, offering offline access but limited collaboration.

- Mobile Apps: Convenient for creating and sending invoices on the go.

- All-in-one Business Management Software: Software that combines invoicing with other business functions like accounting, CRM, and project management.

Choosing the Right Invoice Software for Your Business

Selecting the right invoice software involves careful consideration of several factors:

Source: conta.com

- Budget: Software options range from free plans with limited features to paid subscriptions with advanced capabilities.

- Business Size and Needs: Consider the number of invoices you send, the complexity of your billing, and your integration needs.

- Ease of Use: Choose software with an intuitive interface that is easy to learn and use.

- Customer Support: Reliable customer support is crucial for resolving any issues or questions.

- Security and Data Protection: Ensure the software provider has robust security measures to protect your financial data.

Frequently Asked Questions (FAQ)

- Q: Is invoice software necessary for a small business? A: While not strictly mandatory, invoice software significantly streamlines billing, reduces errors, and improves overall efficiency, making it highly recommended.

- Q: How much does small business invoice software cost? A: Costs vary widely, from free plans with limited features to monthly or annual subscriptions ranging from $10 to $100+ depending on features and user needs.

- Q: Can I integrate invoice software with my accounting software? A: Many invoice software options offer integration with popular accounting software like QuickBooks, Xero, and FreshBooks, streamlining financial management.

- Q: What are the security considerations when choosing invoice software? A: Look for software with robust security features, including data encryption, secure payment gateways, and regular security updates.

- Q: How can I choose the best invoice software for my business? A: Consider your budget, business needs, ease of use, customer support, and security features. Try free trials or demos to compare different options before committing.

Conclusion: Small Business Invoice Software

Implementing small business invoice software is a strategic investment that can significantly improve your financial management and overall business efficiency. By carefully considering your needs and choosing the right software, you can streamline your invoicing process, save time, reduce errors, and ultimately focus on growing your business. Don’t let outdated methods hinder your success – embrace the power of technology to optimize your billing and financial operations.

Source: shareecard.com

References

Call to Action

Ready to simplify your invoicing and boost your business efficiency? Explore the various small business invoice software options available today and choose the one that best fits your needs. Start your free trial or demo now and experience the difference!

Source: synder.com

FAQ

What are the key features to look for in small business invoice software?

Source: synder.com

Key features include customizable invoice templates, automated payment reminders, online payment processing, expense tracking, reporting and analytics, and integration with accounting software.

Source: vodigynetworks.com

Is small business invoice software expensive?

Source: conta.com

Pricing varies greatly depending on features and the number of users. Many options offer free plans for basic usage, while others provide tiered subscription models to suit different business sizes and needs.

Source: welpmagazine.com

How can I choose the best software for my business?

Source: zapier.com

Consider your business size, invoicing volume, desired features, budget, and technical expertise. Try free trials or demos to test different options before committing.

Source: shareasale.com

What if I need help using the software?

Source: medium.com

Most reputable software providers offer customer support through various channels, such as email, phone, or online help centers. Look for providers with responsive and helpful support teams.