In today’s competitive financial landscape, efficient client management is paramount for success. Financial advisor CRM software offers a powerful solution, streamlining operations and enhancing client relationships. This comprehensive guide delves into the intricacies of these systems, exploring their features, benefits, and selection considerations. We’ll cover everything from essential functionalities to advanced capabilities, ensuring you have the knowledge to choose the right CRM for your practice.

Source: vipecloud.com

Understanding the Role of CRM in Financial Advisory

A Customer Relationship Management (CRM) system, specifically designed for financial advisors, acts as a central hub for all client-related information. It goes beyond simple contact management; it facilitates personalized service, improves operational efficiency, and ultimately drives business growth. This is achieved through features designed to manage the entire client lifecycle, from initial contact to ongoing portfolio management and beyond.

Source: outrightcrm.com

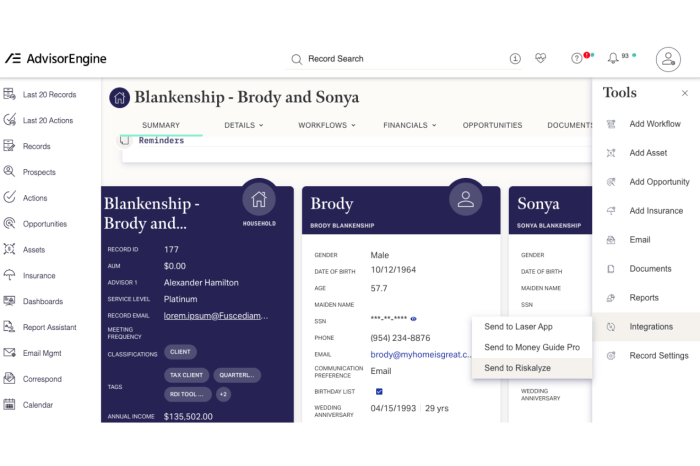

Key Features of Financial Advisor CRM Software

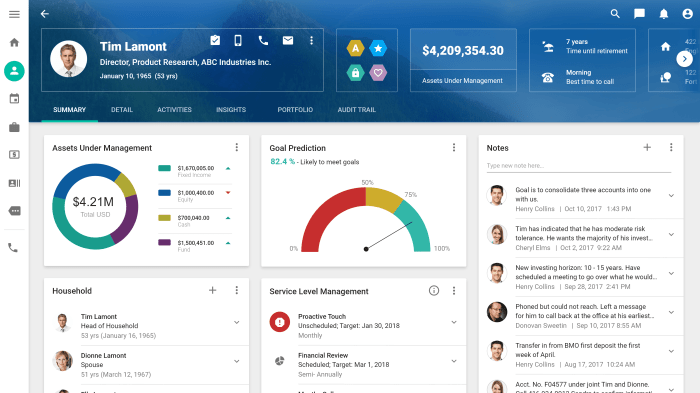

- Contact Management: Centralized storage of client details, including contact information, demographics, financial goals, and risk tolerance.

- Client Portfolio Management: Tracking investment performance, asset allocation, and transactions for each client, often with integration to brokerage accounts.

- Communication Management: Facilitating seamless communication through email, phone calls, and secure messaging, maintaining a detailed audit trail.

- Document Management: Secure storage and retrieval of important client documents, such as agreements, statements, and tax returns.

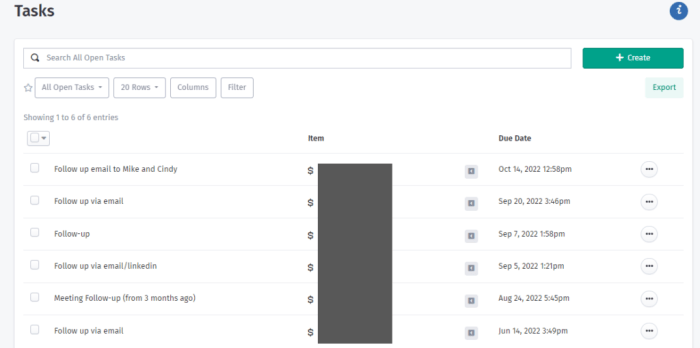

- Task and Workflow Management: Scheduling appointments, setting reminders, and automating follow-up tasks to ensure timely client service.

- Reporting and Analytics: Generating reports on client activity, portfolio performance, and business growth, providing valuable insights for strategic decision-making.

- Compliance and Security: Adherence to regulatory requirements, ensuring data security and privacy through robust encryption and access controls.

- Integration with other systems: Seamless connectivity with other software used in the financial advisory business, such as accounting software and portfolio management platforms.

Benefits of Implementing a Financial Advisor CRM

Adopting a dedicated CRM system offers numerous advantages for financial advisory firms of all sizes. These benefits translate directly into improved efficiency, enhanced client relationships, and ultimately, increased profitability.

Source: leadsrain.com

Improved Client Relationships

- Personalized Service: Access to comprehensive client profiles enables advisors to tailor their services and communication to individual needs and preferences.

- Enhanced Communication: Streamlined communication channels ensure timely and relevant updates, strengthening client relationships and fostering trust.

- Proactive Client Engagement: Automated reminders and follow-up tasks help advisors stay connected with clients, providing proactive support and addressing potential concerns.

Increased Efficiency and Productivity

- Streamlined Workflows: Automation of repetitive tasks frees up advisors’ time to focus on high-value activities, such as client meetings and strategic planning.

- Improved Organization: Centralized data storage eliminates the need for manual searches and reduces the risk of lost or misplaced information.

- Better Time Management: Efficient scheduling and task management tools optimize advisors’ time, enabling them to serve more clients effectively.

Enhanced Business Growth, Financial advisor crm software

- Improved Client Retention: Personalized service and proactive engagement contribute to higher client satisfaction and loyalty.

- Increased Revenue Generation: Improved efficiency and client retention lead to increased revenue and profitability.

- Data-Driven Decision Making: Comprehensive reporting and analytics provide valuable insights into business performance, informing strategic decisions and optimizing growth strategies.

Choosing the Right Financial Advisor CRM Software

Selecting the appropriate CRM involves careful consideration of various factors. The ideal system should align with your firm’s specific needs, size, and budget.

Source: revopsteam.com

Key Considerations

- Scalability: The system should be able to accommodate your firm’s growth, both in terms of client base and team size.

- Features and Functionality: Ensure the CRM offers the essential features and functionalities discussed earlier, tailored to your specific requirements.

- Integration Capabilities: Consider the system’s ability to integrate with other software used in your practice, such as accounting software and portfolio management platforms.

- User-Friendliness: The CRM should be intuitive and easy to use for all members of your team, minimizing training time and maximizing adoption.

- Cost and Pricing: Evaluate the cost of the software, including licensing fees, implementation costs, and ongoing maintenance.

- Security and Compliance: Verify that the system adheres to relevant regulatory requirements and provides robust data security features.

- Customer Support: Assess the quality and responsiveness of the vendor’s customer support team.

Popular Financial Advisor CRM Software Options

Several reputable vendors offer CRM solutions specifically designed for financial advisors. Researching different options and comparing their features is crucial before making a decision. Some popular choices include (Note: This is not an exhaustive list, and the suitability of each platform depends on individual needs): Salesforce Financial Services Cloud, Redtail CRM, Wealthbox, and AdvisorPeak.

Source: pttrns.com

Frequently Asked Questions (FAQ)

- Q: How much does financial advisor CRM software cost? A: Pricing varies significantly depending on the vendor, features, and number of users. Expect a range from monthly subscription fees to one-time purchase options.

- Q: Is CRM software necessary for small financial advisory firms? A: Even small firms can benefit significantly from a CRM, streamlining operations and improving client relationships despite their size.

- Q: How long does it take to implement a CRM system? A: Implementation time varies depending on the complexity of the system and the size of your firm. Expect a timeframe ranging from a few weeks to several months.

- Q: What are the key performance indicators (KPIs) to track after implementing a CRM? A: Key KPIs include client retention rate, client acquisition cost, revenue per client, and advisor productivity.

- Q: Can a CRM integrate with my existing accounting software? A: Many CRMs offer integration capabilities with popular accounting software packages. Check the vendor’s specifications to ensure compatibility.

Conclusion: Financial Advisor Crm Software

Financial advisor CRM software is an invaluable tool for enhancing efficiency, strengthening client relationships, and driving business growth. By carefully considering your needs and researching available options, you can select a system that empowers your firm to thrive in the competitive financial services industry. Investing in the right CRM is an investment in your future success.

Source: vipecloud.com

References

While specific product links are avoided to maintain neutrality and prevent outdated information, general research on the mentioned software (Salesforce Financial Services Cloud, Redtail CRM, Wealthbox, AdvisorPeak) on their respective websites and through reputable review sites will provide detailed information. Further research on topics like “Financial Advisor CRM Best Practices” and “Choosing the Right CRM for Financial Advisors” on sites like Investopedia and industry publications will provide valuable insights.

Source: soloway.tech

Call to Action

Ready to transform your financial advisory practice? Contact us today for a free consultation to discuss your CRM needs and find the perfect solution for your firm.

Source: welpmagazine.com

FAQ Section

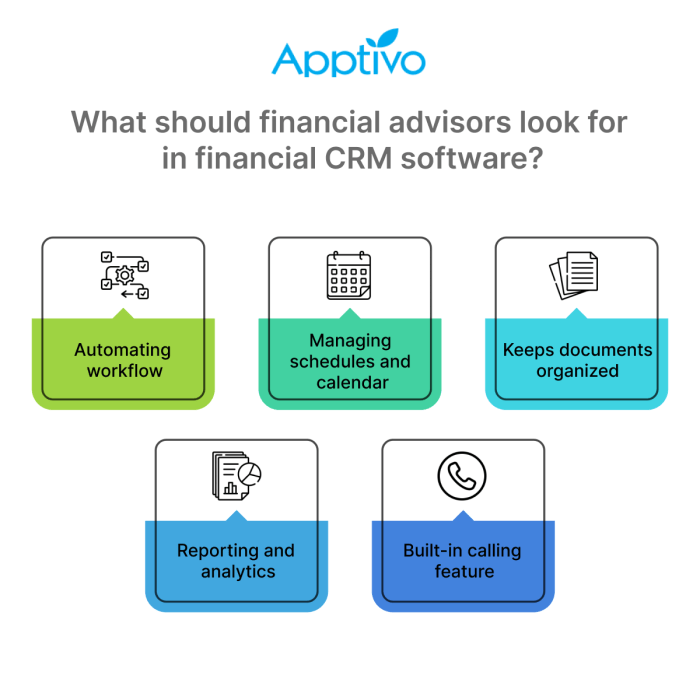

What are the key features to look for in financial advisor CRM software?

Source: findmycrm.com

Key features include client relationship management (contact details, communication history), task automation (appointment scheduling, email marketing), reporting and analytics (performance tracking, client segmentation), integration with other financial tools, and security features to protect sensitive client data.

Source: founderjar.com

How much does financial advisor CRM software typically cost?

Source: marketcircle.com

Pricing varies widely depending on the features, scalability, and vendor. Expect to find options ranging from affordable monthly subscriptions to more expensive enterprise solutions with customized features. It’s essential to compare pricing models and features before making a decision.

Source: com.au

Is CRM software difficult to learn and use?

Source: apptivo.com

Most modern CRM systems are designed with user-friendliness in mind. Many offer intuitive interfaces and training resources to help users get started quickly. However, the learning curve can vary depending on the complexity of the software and the user’s technical proficiency.

Source: soloway.tech

How can I integrate my existing financial planning software with a CRM?

Source: senjanesia.com

Many CRMs offer integrations with popular financial planning software through APIs or third-party connectors. Check the CRM’s compatibility list or contact the vendor to determine integration possibilities with your specific software.